VALUE ADDED TAX IN THE UAE

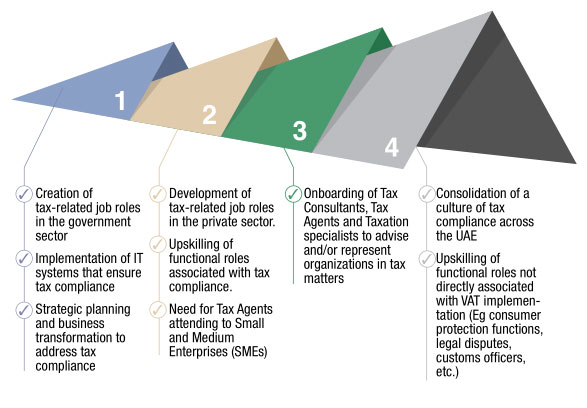

The UAE Federal Government introduced the Value Added Tax (VAT) on a range of goods and services, effective from January 1, 2018. The emergence of new functional roles associated with indirect tax policy, administration and regulation, will require the training and professionalization of new cadres of UAE Nationals to join the strategic governmental vision. VAT implementation has a broad scope of impacts in the UAE economy.

Scope of the impact of VAT framework on institutions and individuals

ABOUT THE VAT ACADEMY

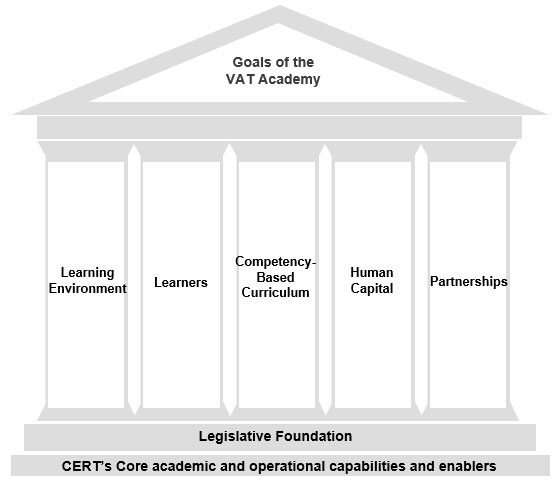

The Centre of Excellence for Applied Research & Training (CERT) launched its VAT Academy with the mission to create a framework of tax competencies and capacity development, through bespoke training programs and certifications for the UAE public and private sector. CERT has therefore built on its solid industry experience preparing UAE Nationals employed in public and private institutions, through the engagement of taxation experts and HCT faculty specialized in training in the areas of Accounting, Auditing, Public Policy, Compliance and Tax-related technology.

CERT’s VAT Academy has the mission to create a framework of tax competencies and capacity development, through bespoke training programs and certifications for the UAE public and private sector.

VAT ACADEMY PRIORITIES AND STRATEGIC GOALS

The VAT Academy aligns to the following government and organization strategies:

| Priority 1 : | Federal Government Priority: Ministry of Finance Strategic Plan 2017-2021. |

|---|---|

| Priority 2 : | Abu Dhabi Vision 2030: Align TVET qualifications and system capacity with Labour Market demand. |

| Priority 3 : | Abu Dhabi Vision 2030: Increase the competency and employability of Nationals for participation in the workforce. |

The CERT VAT Academy has the following primary strategic goals:

- Establish a taxation competency-based framework for the public and private sector based on professional and occupational standards.

- Support capacity development in government functions related to Tax Policy and Tax Regulation.

- Promote Tax Compliance and Professional Integrity through training programs that enhance organizational competencies.

- Provide Taxation certification and training programs aligned to international body of knowledge.

- Prepare UAE Nationals and improve their employability in tax-related roles in the public and private sector.

- Position as the preferred professional and vocational education taxation center in the UAE.

OUR PARTNERSHIPS

The VAT Academy cooperates with knowledge partners to provide professionally recognized certifications and qualifications in the UAE:

- Partnerships with Government and Semi-Government entities to socialize knowledge of VAT in the business community.

- Partnerships with international institutions to develop and deliver taxation certifications and qualifications.